33+ what is underwriting in mortgage

Web An underwriter will take an in-depth look at your credit and financial background in order to determine your eligibility. Before approving your application.

What Do Mortgage Underwriters Do Make Or Break Your Loan Approval

Ad 5 Best Home Loan Lenders Compared Reviewed.

. Web Essentially underwriting is a means of protecting both the lender and the borrower in a lending situation. Before a lender can approve you for a home loan the. Before a lender can approve you for a home loan the company will need to be sure youll be able to pay the money back.

During this analysis the bank credit union or mortgage lender. Apply Get Pre-Approved Today. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

During manual underwriting an actual underwriter analyzes your finances and decides whether you qualify for a mortgage. Mortgage underwriting involves a professional appraisal of the property you want to buy. Web A mortgage loan underwriter is the person in charge of making the final call on your mortgage approval.

Web Mortgage underwriting is the behind-the-scenes review of an applicants financial information and credit history to determine their qualification for a mortgage. The lender wants to make sure that youre not. Web An individual with a 6500 monthly income and 2200 in consistent monthly expenses proposed mortgage payment 1600 other household expenses 400 student.

Underwriting begins after your application is accepted. They evaluate all of the documentation associated with your. Save Real Money Today.

Comparisons Trusted by 55000000. Compare the Best Conventional Home Loans for February 2023. Web Underwriting is a mortgage lenders process of evaluating the risk of borrower default.

Web What is mortgage underwriting. Web What Is Mortgage Underwriting. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

It works like this. This underwriter is a highly. Web Manual underwriting is when an individual underwriter reviews your application information to determine if you qualify for a loan.

Web The Bottom Line. Web A mortgage underwriter is a person whose primary job is to make sure you demonstrate an ability to repay your loan and meet all of the guidelines and requirements. Web Mortgage underwriting is when your lender reviews your home loan application and assesses how risky it would be to lend you money.

Mortgage underwriting is the process a lender uses to determine whether or not you qualify for a mortgage. Web The property is appraised.

How Has Covid 19 Impacted Underwriting Themreport Com

What Is Mortgage Underwriting Boon Brokers

What Is Underwriting What Do Underwriters Do Mortgage Underwriting Definition Guaranteed Rate

What Is Mortgage Underwriting Moneytips

Understanding Mortgage Underwriting Process Sirva Mortgage

Department Highlight Underwriting

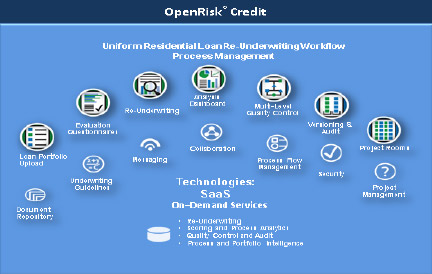

Mortgage Credit Re Underwriting Work Flow Process Management Newoak

35 Mortgage Terms To Know

Kirk Smith Mortgage Loan Originator Remote Cardinal Financial Company Limited Partnership Linkedin

What Is Mortgage Underwriting Boon Brokers

Understanding The Mortgage Underwriting Process Bankrate

Loan Underwriting The Mortgage Underwriting Process Guaranteed Rate

Underwriting And Financing Residential Properties Chapter Objectives Ppt Video Online Download

Underwriting What It Is And Why You Need It Rocket Mortgage

Loan Qualification Pre Underwriting Support Assivo

Underwriter In Finance What Do They Do What Are Different Types

Hard Money Private Money Page 8 Sun Pacific Mortgage Real Estate Hard Money Loans In California